COVID-19 accelerates global data centre competition and capacity challenges

While the pandemic has wreaked much disruption to international construction markets, the data centre industry has largely bucked global trends during 2020 – accelerating with new-found urgency through the COVID-19 crisis to meet the demand for capacity.

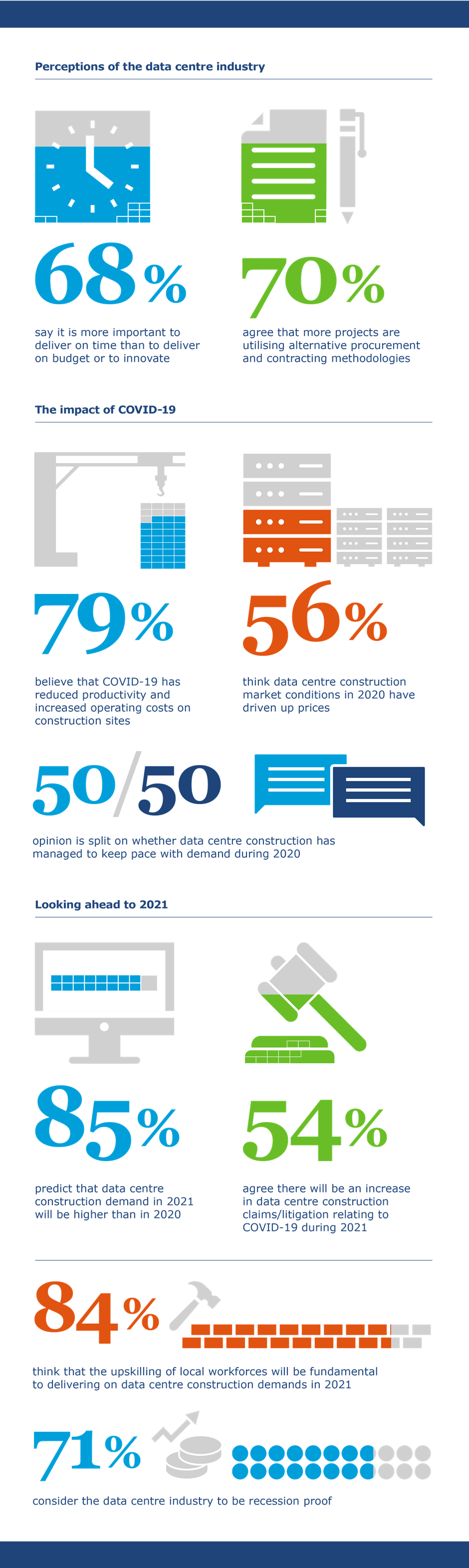

Worldwide lockdown measures sparked a surge in internet use and a significant increase in businesses outsourcing services to the cloud, as employees shifted en masse towards remote working. Already growing as a hot ticket investment, data centres have emerged as a key priority market in the context of a global pandemic. 71 percent of our survey respondents now consider it to be a recession proof industry – up from 50 percent last year.

This can be evidenced by the busy development market during 2020 – with substantial site acquisition activity and a blitz of pre-development work undertaken. A lot of this investment has been concentrated in the secondary European markets, where there lies significant untapped potential.

Yet industry opinion is split 50:50 on whether data centre construction has managed to keep pace with demand during 2020.

The data centre sector has been plagued by productivity setbacks as a result of COVID-19 and the implementation of social distancing measures on sites, combined with a stretched international construction supply chain that was already approaching breaking point prior to the pandemic.

Our study finds that 79 percent believe COVID-19 has caused productivity losses and higher operating costs on data centre construction sites.

The current crisis, and increasingly competitive nature of the market, has starkly exposed the fragility of the global supply chain and its potential to curb future growth. Data centre providers need to be alive to the very real risks of contractor insolvency and knock-on impacts to projects.

In our survey, 55 percent of respondents believe there will be a rise in data centre construction claims and litigation in 2021 linked to COVID-19.

Global construction market inflation

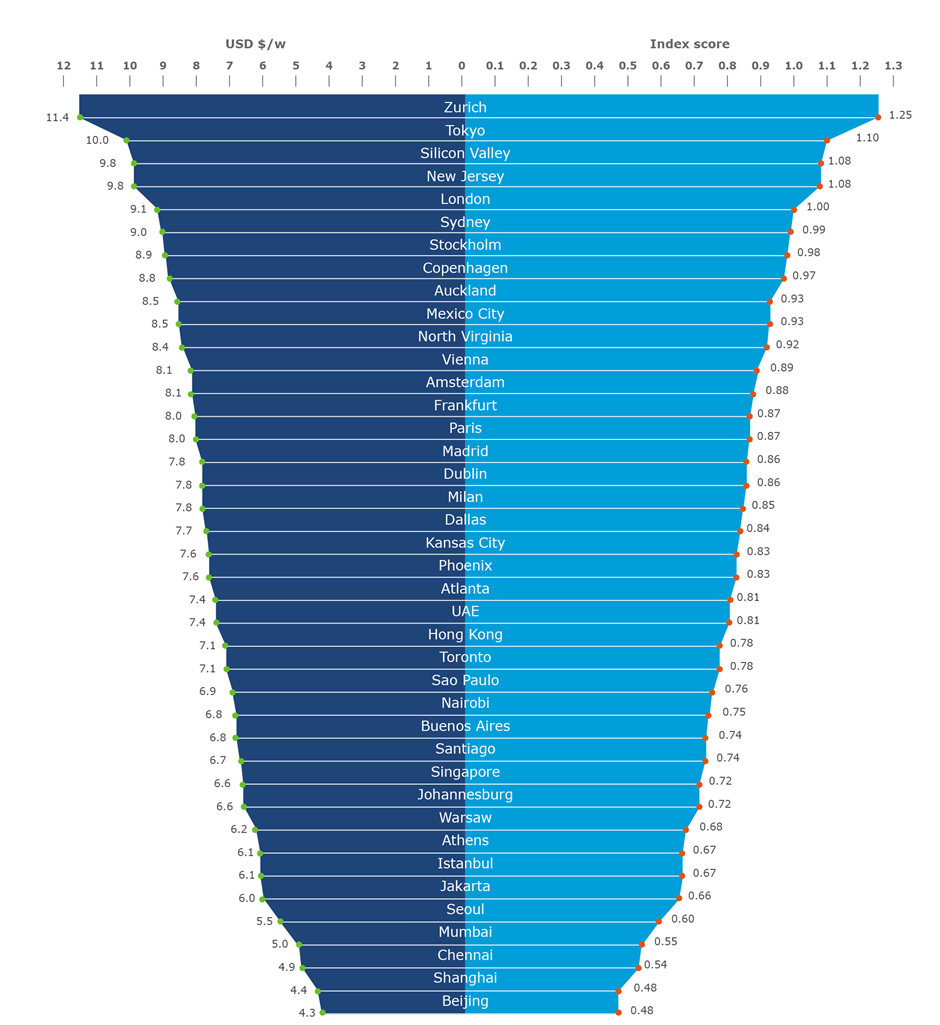

Against this backdrop, 57 percent think market conditions in 2020 have driven up data centre construction prices. This year we have created an index of construction costs of 40 key data centre markets globally, up from 32 locations last year, which reflects the growing importance of secondary markets.

The most expensive data centre market in the world continues to be Zurich, still the epicentre of European expansion for many global providers and it is set to host a new infrastructure region for Amazon Web Services from 2022.

Google and Microsoft are also opening new regions with the next few years, as the leading cloud service providers continue unabated with their expansion plans.

With build costs in California’s Silicon Valley and New Jersey remaining high at $9.8/w, US hyperscale investment and growth is being focused on lower-priced markets such as North Virginia ($8.4/w); Texas ($7.7/w) and Arizona ($7.6/w). Markets to watch include Kansas City and the wider Midwest ($7.6/w) and Atlanta ($7.4/w).

London has overtaken Sydney, Stockholm and Copenhagen this year to reach fifth place in the table of data centre construction costs, in what is expected to be an extremely hot market during 2021 as hyperscale investment comes to the British shores, with Brexit a potential accelerator.

It now costs the same to build a data centre in Frankfurt as it does in Paris, just behind Amsterdam, as growth continues across the traditional Frankfurt, London Amsterdam and Paris (FLAP) markets.

The squeeze on development schedules

With the global clamour for new capacity and operators all vying to retain competitive advantage, schedule and speed to market remains king.

Our survey shows that 68 percent of people across the industry now see delivering data centres on time as more important than delivering on budget or innovating.

Providers are increasingly needing to push aggressive schedules to bring new capacity onstream quickly and deliver against their service commitments. They need to have confidence in their development pipeline and programmes, and data centre contractors who can deliver the pace required hold commercial advantage – and considerable risk alongside it.

To be competitive in the current climate, hyperscale data centre construction schedules need to be condensed from the traditional 15-18 months to 9-12 months. The full hyperscale development cycle is under pressure to reduce from 24-36 months to 18-24 months.

Meeting the need for speed

Committing to these aggressive schedule gains requires confidence in a procurement and delivery model. Within the debt-financed wholesale ‘build to suit’ market, the contractual hierarchy can be complex.

Yet our research suggests that all data centre owners/operators have their own unique attributes to delivering their capital programmes. No two organisations have the same supply chain procurement strategy, approach to design risk transfer or underpinning contracting methodology.

But seemingly everyone is prepared to adapt in search of the winning formula and the competitive edge, with 70 percent of our respondents agreeing that more data centre projects are using alternative procurement and contracting methodologies.

A summary of the results of our online survey of data centre industry players is highlighted below.

Localisation to enable growth

Future data centre expansion also hinges on tackling the sector’s severe skills shortage. As an industry, we need to invest in building long-term capability within different global markets. Regional skills strategies are critical if we are to build greater local resources and skills bases.

Currently, we have a very small, specialised data centre supply chain servicing an enormous, global market. This needs to change if we are to meet the capacity challenge ahead.

Our survey finds that 84 percent think the upskilling of local workforces will be fundamental to delivering data centre construction demand in 2021.

In particular, greater localisation will be vital to building future resilience in the market. The development impacts of COVID-19 would have been significantly lessened if the global industry was not so reliant on a small pool of specialist talent and the fly-in and fly-out nature of this expertise.

The pandemic has shone a light on how unsustainable this model is, but also created a unique platform with which to promote the career opportunities in the sector – and highlight the critical work and societal progress data centres support.

Looking ahead to 2021

2021 is going to be a big year for data centre construction, off the back of the boom in site acquisitions and investment this year, and making up for lost time on site during the COVID-19 crisis. 85 percent of our respondents forecast that data centre construction demand in 2021 will be higher than in 2020.

Growing demand and expanding cloud regions are set to make Europe the number one investment market for US cloud and data centre operators.

As the market reaches a new stage of maturity, we are going to see continued investment in the traditional FLAP markets but continued growth and investment in secondary data centre markets of Berlin, Warsaw, Milan, Madrid and Vienna.

Istanbul and Athens are also attracting greater attention since both cities act as important strategic gateways into Africa, Asia and the Middle East.

Globally, we see hotbeds of activity in India, Indonesia, Mexico and Brazil in particular. Auckland is a new exciting market to watch, with Microsoft reportedly having recently been granted approval for a $100m data centre here.

With cloud adoption on the rise across Africa, Ethiopia and Nigeria are also emerging as key data centre markets primed for growth in 2021.

Across all of these markets, there is huge opportunity for growth, but investment needs to be matched with a mindful eye on data centre construction costs and supply chain capability.

Regional insights

Methodology

To generate the results of our data centre cost index 2020, our proprietary cost model was updated. The cost model individually assesses each of the six key capital cost headings: shell and core; equipment; construction labour; construction materials; preliminary costs/general conditions and general requirements; and margin/profit for each of the 40 markets featured.

All costs are converted into a single currency, in this case USD, using the foreign exchange rates advised by our economists.

Baseline model assumptions

A greenfield 30MW IT load data centre in the central US region was used as a baseline. It assumed a power density of 3,000W/m2 with a net lettable to gross floor ratio of 1.8.

Shell and core

Our network of regional offices provided parametric costs (per m2) for actual data centre shell and core construction expenses, where available.

Equipment

Actual quoted equipment costs have been applied and factored in as necessary. Additional costs per location are also applied for local sales tax/VAT, import duties and freight.

Construction labour

Our baseline model includes actual construction hours, factored in and categorised by key trade with associated hourly rates from our local businesses.

A productivity assessment table was developed comparing each of the 40 markets for the impact of regulations, skills and cultural/religious variances. We have then applied a ratio of expatriate labour resources anticipated to be involved, resulting in a blended rate.

Construction materials

A material price index was developed using typical material costs in each location, weighted for relevance to data centre construction.

Preliminaries/general conditions and general requirements

Percentage points were added based on our analysis of tender returns, where possible, for relevant projects throughout 2020.

Margin/profit

Percentage points were added based on our analysis of tender returns, where possible, for relevant projects throughout 2020.

Exclusions

The cost model does not include any client direct costs, land purchase costs, utility works, groundworks, site works, active IT equipment, fibre cabling to support office fit-outs or professional services fees.

Online survey

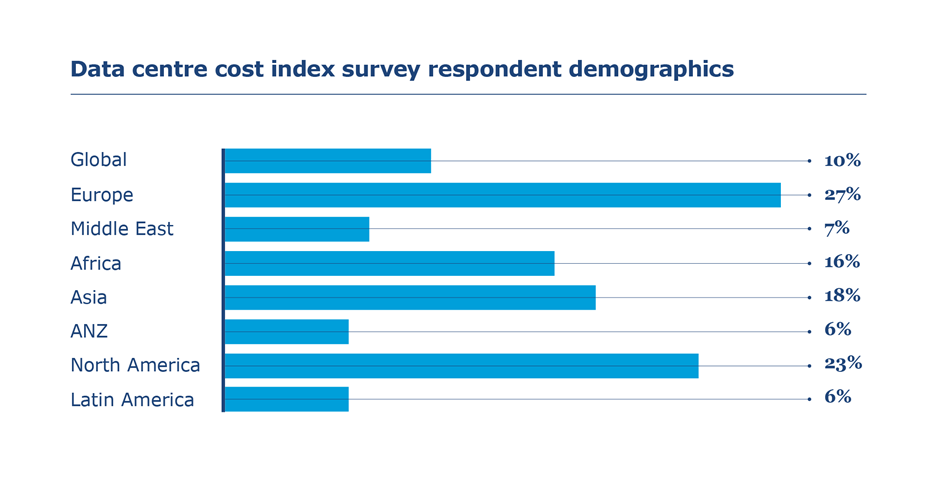

In November 2020, we ran an online survey to gauge the views of data centre sector players on industry trends. We received a total of 162 responses. Our respondents were based in/responsible for the following regions:

Find out more our data centre cost index

We are confident that our data centre cost index will become a reliable industry benchmark for those involved in data centre construction. If you’d like to determine an estimated outturn cost for your specific project, or to contribute new market information to our model, please get in touch, we’d be delighted to hear from you.