Warehouse construction costs escalate

The COVID-19 pandemic has highlighted the interconnectedness of our world and the fragility of global value chains. As countries have emerged from lockdowns and demand for products and resources has soared, an international supply chain crisis has ensued – causing the greatest supply shock in a generation.

Businesses have had to react, adapt and set up crisis management mechanisms to weather ongoing uncertainty – changing the business environment for organisations around the globe.

Many businesses have evolved their operating models by raising inventory levels so they have adequate stocks of materials and products – moving from ‘just in time’ to ‘just in case’ strategies. The trend for re-shoring operations is gathering momentum, creating more regional and localised supply chains to provide businesses with greater levels of certainty and ‘what if’ resilience.

Against this backdrop, many regions are experiencing growing shortages in industrial space. A highly active global warehouse construction market is struggling with acute labour and material constraints.

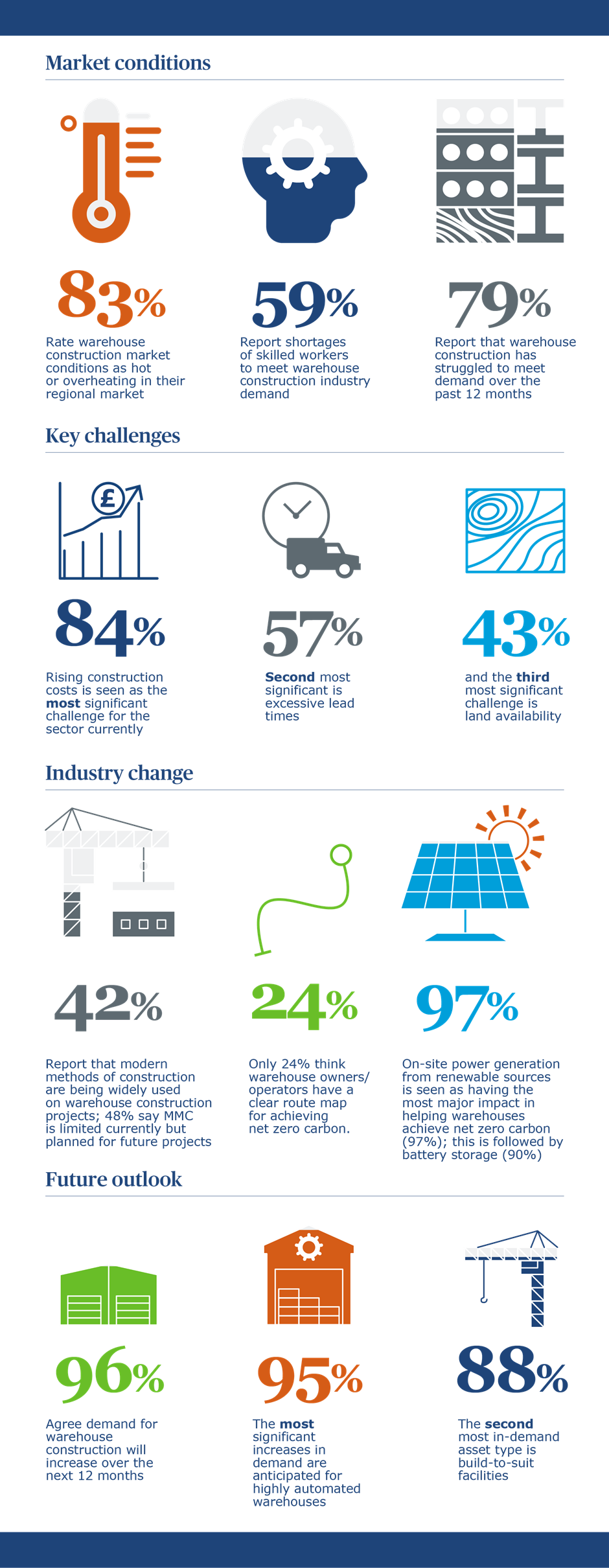

Our 2021 Warehouse cost index underlines these challenges. 79 percent of survey respondents report that warehouse construction has struggled to meet market demand over the past 12 months and 83 percent report warehouse construction conditions are hot or overheating – characterised by a high volume of projects, intense competition and resource scarcity. These factors are combining to drive up prices.

Supply chain turmoil fuels cost escalation

The current supply chain crisis is driving up costs for key building materials such as steel, copper and aluminium around the world. 84 percent of survey respondents report that rising construction costs are a major challenge for the warehouse sector currently.

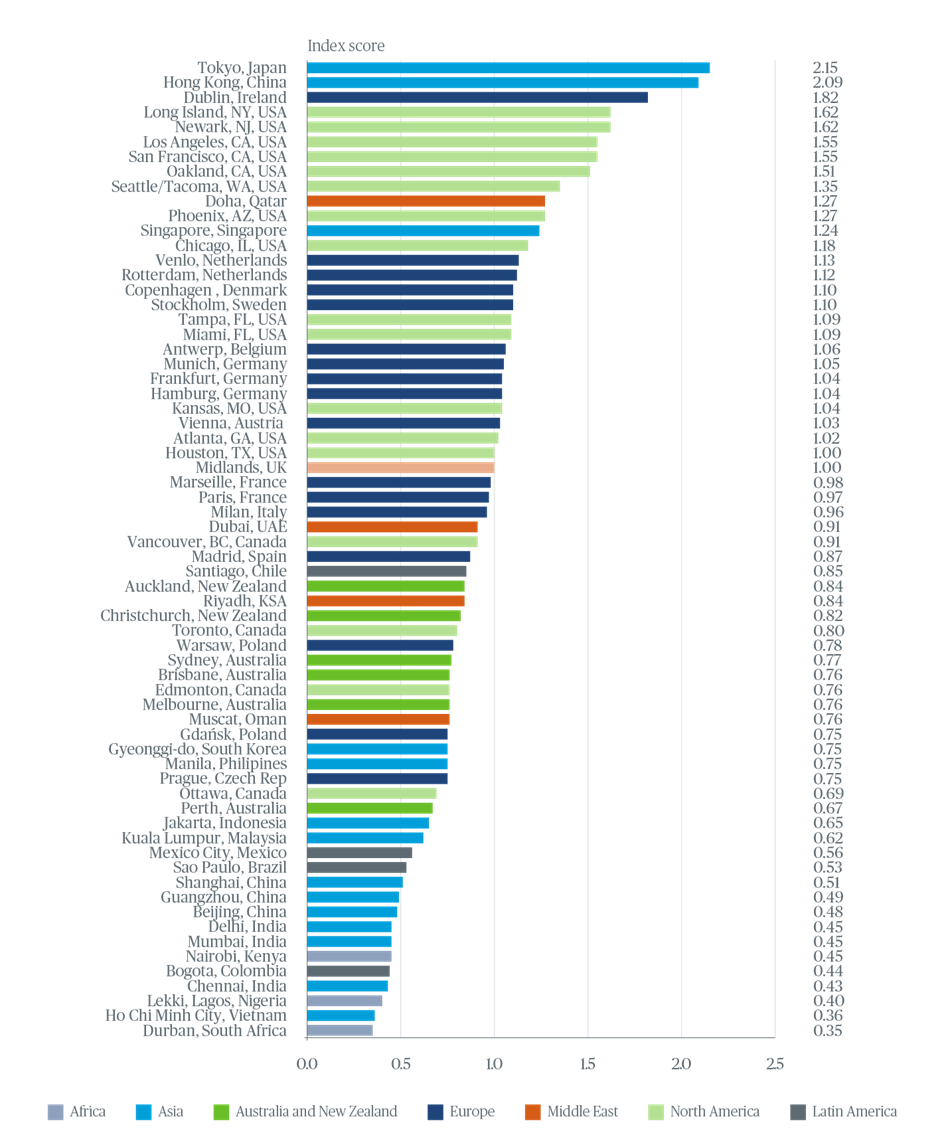

To give a picture of the global cost landscape for warehouse construction we have created an index of 66 key logistics markets. We have based our index on an institutional warehouse project in the UK Midlands (equal to one), benchmarking the cost to build to the same specification across the world.

Increasing costs for warehouse construction has become an accepted normal as a result of heated investment in new logistics projects over the past decade. However, supply chain friction and the increasing difficulty of obtaining labour and materials in 2021 has fuelled above average cost inflation, while providing an opportunity for supply chains to increase margins.

The global cost data we have drawn upon to form our index shows an escalation in average cost, ranging between five to 15 percent across the global warehousing industry, with some of the highest rates of inflation being seen in Tokyo, Hong Kong, Dublin, Doha and across the US.

Although it is very difficult to predict when construction costs will plateau, further volatility is anticipated over the next nine to 12 months in most markets, as the supply chain crisis continues. It will likely be Q3 2022 before there is any real stabilisation, although the coming period is probably not going to be as turbulent as the previous 12 months.

Tokyo has taken the title as the most expensive location for logistics real estate. Much of Japan’s logistics infrastructure needs to modernise and the current e-commerce boom is driving a need for new warehouse space. Cost inflation is being exacerbated by local construction market dynamics, particularly by the fact there are just five main contractors, causing capacity challenges.

Hong Kong is now the second most expensive market. The city’s zero COVID-19 policy and tough quarantine rules have added to supply chain disruption at the port and airport for this highly import-dependent market. However, plans for a Hong Kong International Airport logistics park, which would create an intermodal cargo network within the Greater Bay Area, have recently been confirmed.

Dublin has been catapulted into the top three most expensive locations after being ninth in our index in 2020. Delays, additional paperwork and extra costs created by Brexit have created a complex landscape for logistics projects in Ireland. Demand for additional space has been created by shifts in the composition of goods traded, stockpiling and alterations to transport routes following Britain’s departure from the EU.

US port-side locations including Long Beach Oakland and San Francisco also feature in the top ten. In addition to price escalation, excessive lead times is a critical challenge currently. Congestion and backlogs at US ports means thousands of full containers are sitting offshore, waiting an average of 8.7 days for a spot at the port. Fewer containers in use means higher prices and more stress on the system. Backlogs at West Coast ports have also pushed shippers to use East Coast ports like Savannah, Charleston and New York/New Jersey (via the Suez Canal), thus increasing transport costs even further.

Across the world, the imbalance of trade caused by congestion at ports and a lack of shipping containers shows no signs of abating. Ocean containers have increased from a pre-pandemic $3,000 per container to current trading prices of $25,000 a container. Businesses have had no choice but to absorb these increased prices in order to secure passage for their goods. Given dwindling container capacity, some companies have resorted to contracting private vessels to transport their merchandise from Eastern to Western markets.

Re-shoring is re-engineering value chains

As a result of these challenges, the trend for re-shoring, onshoring or nearshoring of operations is building momentum. However, mitigating COVID-19 supply chain disruption is not the only driver at play. Increased consumer demand for fast delivery times, rising wages in China and India, and the drive for net zero carbon all have a bearing. Furthermore, re-shoring strategies have political backing in many countries as governments seek to ensure greater resilience for their economies.

This trend can be seen across North America and Europe, particularly in sectors such automotive, semiconductor and electronics, aerospace, medical suppliers, and soaps/hygiene products. Volkswagen, General Motors and Ford are notable names that are transitioning some operations closer to key markets. These companies are seeking to mitigate uncertainty, maintain (and grow) market share, ensure quality and manage the total cost of ownership through regional and localised supply chains, rebalancing and diversifying their supply chain and partners.

Re-shoring is undoubtedly impacting the size of warehouses and distribution centres, driving the need for additional space and larger domestic footprints. However, the logistics industry cannot add additional floor space and ‘just in case’ resilience easily. In particular, a lack of available land with planning certainty was highlighted as a major challenge by 43 percent of survey respondents.

Skills shortages drive industry change

Skills shortages have also continued to be a key challenge for the warehouse construction industry, further exacerbated by the COVID-19 pandemic. Nearly 60 percent of respondents reported that their market is suffering from a shortage of skilled workers to meet warehouse construction demand.

Offsite assembly offers the potential to ease the pressure of ongoing on-site labour shortages. 42 percent of respondents report that modern methods of construction (MMC) are being widely used on warehouse construction projects, and 48 percent report that MMC is planned for use on future projects, indicating that adoption is increasing across the industry.

At the operational level, while automated warehouses are not a silver bullet to the sector’s resource challenges, more advanced technology may help alleviate staff recruitment issues. High levels of automation are now integral to many new builds. 95 percent of respondents forecast that the most significant increase in demand will be for highly automated warehouses. Adding greater levels of automation is not about return on investment for many occupiers, it is about continuity of business. Shortages of warehouse workers has driven up wages in the sector in the short-term. Increased levels of pay may become the new norm.

Driving net zero logistics

Against the backdrop of the global climate emergency, the transition of warehouse buildings and wider distribution networks to net zero is rapidly rising up the agenda. But alarmingly only 24 percent of respondents currently believe warehouse owners and operators have a clear route map for achieving net zero carbon.

Taking a balanced view, the logistics experts we interviewed to inform our report felt that significant progress was being made to prepare warehouse buildings for net zero. In our survey, on-site power generation from renewable sources is seen as having the biggest impact in helping warehouses achieve net zero (97 percent) followed by battery storage (90 percent). Both are seeing increasingly widespread adoption at warehousing sites.

However, the warehouse and logistics sector’s greatest environmental challenges lie in reducing transport emissions across air, road and sea. This remains a significant issue, as anecdotal insight from third party logistics operators and some logistics consultants revealed that port congestion is currently leading to some operators transporting some products by air which would previously have been shipped by sea freight. However, this is nevertheless likely to only be a temporary backwards step, with evidence building that the industry is on a longer-term trajectory to drive net zero.

Regional warehouse sector insights

Views from the logistics industry

Jim Mulhern, Senior Vice President Global Head of Business, DHL

“Delivering net zero for the logistics sector will not be achieved by just cutting carbon in warehouses. Our industry’s biggest carbon emissions come from transport emissions across air, road and sea transport, so when we are looking at partnerships with third parties the focus is on reducing emissions.

DHL is on a journey to net-zero by 2050, and we're committed to investing £7 billion over ten years in our transition to this goal.

"Our new partnership with United Airlines, via there SAF program, is focused on investing in sustainable jet fuels. DHL express has also acquired 12 new electric planes capable of transporting commercial goods up to 850 kilometres.

Transparency across the supply chain is key in the drive to net zero because if you can’t measure it, you cannot reduce it.

"We’re increasingly analysing the footprint of journeys but the challenge we all face in the industry is that we currently don’t know what type of vessel or aircraft a shipment might be on.

“Customers are looking closely at the UN Sustainable Development goals and there are markets such as fashion where sustainability is often the defining contractual factor for some brands rather than price. Companies in turn are becoming more honest about the cost of net zero to the consumer and this will undoubtedly increase over the next few years.”

Rene Buck, CEO, BCI Global

“We’re continuing to see a re-engineering of supply chains to provide companies with greater resilience. During the early part of the pandemic, some companies became very aware that their supply chains were too reliant on China. After the Trump administration’s trade war with China, many US businesses had already started to look at alternative supply chains focused on decentralising their production and distribution facilities.

“The result has been more investments in South-East Asia, larger inventories in the main Western markets and reshoring back to the US and Europe, with a drive for businesses to bring supply chains closer to their markets.

This trend has undoubtedly driven the level of increased take-up in the industrial real estate sector.

“While businesses can build up inventories close to their operating markets, the reality is that trade does rely on global value chains. Production of the COVID-19 vaccine is a great example of the importance of these value chains because one dose requires 286 components from 19 plants in 13 countries.”

Decarbonising global value chains is the real net-zero challenge.

Developers and investors can ‘green’ industrial buildings and are making progress in this area, but the challenge is also to reduce emissions across aviation and shipping. With the current imbalance of containers and congestion at ports, some global businesses are now even transporting goods by air which historically would be transported by container ships.”

John Caltagirone, Executive Lecturer and Faculty Lead, Loyola University Chicago

“The pandemic has undoubtedly exposed existing frailties in global supply chains and the vulnerability of just in time models.

More businesses are rightly focused on the total cost of ownership and how much it really does cost to have a product sitting in a container at a port.

“This has also been the driver for many businesses to recalibrate the size of their supply chain networks and with that the size of distribution centres.

“We’re currently in a cycle where distribution centres are getting larger across the world. The challenge with the large distribution centre or an exclusive focus on a small number of global regions is that businesses are not spreading risk or planning for disruption which is a constant business threat.

My recommendation is that businesses should undertake an annual network optimisation study every year. With the sheer pace of change across technology, society and customer needs, it’s no longer viable to do this exercise every five years.

Methodology

Index

To generate the results of our Warehouse cost index 2021, we have created a proprietary cost model.

Our baseline model, from which the index is formed, is based upon a warehouse project in the UK Midlands (equal to "1" on our index chart). Approx. cost per sq. ft.: £41.80 (US$55).

Baseline model assumptions and exclusions:

Construction costs only for a typical UK "standard institutional warehouse" of 550,000 sq. ft. unit. No abnormal items.

- Floor slab to 50kn/m2 load

- Portal frame to support 15m to underside haunch height and no abnormal loads

- Maximum of 10t racking loading on ground floor slab

- Envelope with 15 percent roof-lights

- One dock per 7,000-10,000 sq. ft. for a cross-dock facility

- 2 x 50 m deep yards

- Five percent open plan office with comfort cooling to a CAT A standard including entrance

- Warehouse – emergency lighting only – no other services distribution

- Incoming power – 3 MVA

- 200 HGV spaces

- Hub office on each side of main elevations

- 450 car parking spaces

- Sprinkler bases only – fit-out by tenant

- Gatehouse

- No pits

- Minimum of BREEAM Very Good and EPC rating of A

- No internal services or any equipment to warehouse – this is a shell ready for tenant to fit-out

Online survey

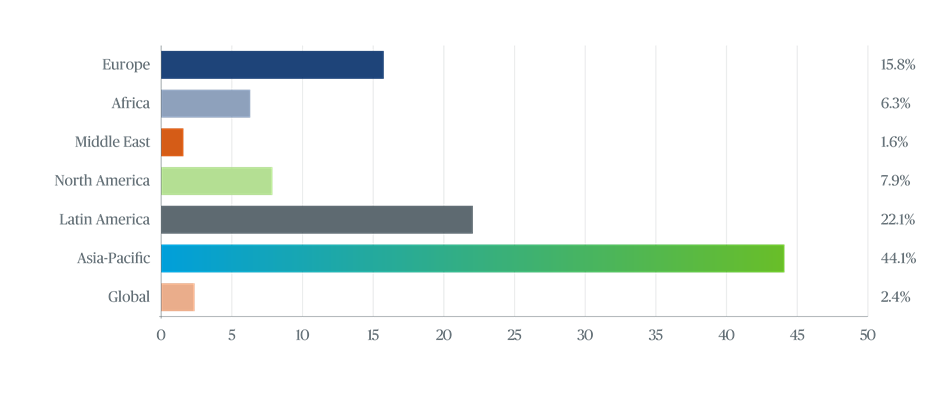

In October 2021, we ran an online survey to gauge the views of warehouse sector players on logistics industry trends. We received a total of 127 responses. Our respondents were based in/responsible for the following regions:

Find out more about WCI

We are confident that our Warehouse cost index is a reliable industry benchmark for those involved in warehouse construction. If you’d like to determine an estimated outturn cost for your specific project or to contribute new market information to our index, please get in touch.

Dan R. Robinson III

Director

e: [email protected]